Investment and financial management is an important part of modern life. How do novices invest and manage money? The following is a guide for novice investment and financial management shared by us. Welcome to read it!

First: Correct concept is the most important

How do novices invest and manage money? Many people misunderstand that wealth management is the patent of the rich. In fact, regardless of the amount of money, it is necessary for individuals or families to manage money. From the perspective of concept, it is not difficult to do a good job in financial management. It is to use and deal with money effectively, so that all expenses can play the maximum effect, and then use various ways to increase income and expenditure, adjust income and expenditure, and constantly accumulate wealth to achieve the desired goal, including overseas travel, property preparation, reserve children's education fund, and pension preparation. In addition, maintaining the purchasing power of money and fighting inflation are also the purposes of financial management.

Second: Set goals

However, not everyone can manage money effectively and correctly. In the process, there must be comprehensive planning, continuous implementation and timely correction. How do novices invest and manage money? According to the needs of different stages, clearly set goals, plan to save the required costs, and complete those goals and hopes one by one. In terms of family financial management, financial management planning should include three levels, such as setting family financial management objectives first, mastering current income and expenditure assets, and using investment to accumulate wealth. That is to say, set goals for different periods and stages, make clear the income and expenditure situation and balance sheet situation at the current stage, measure whether there is enough financial resources to achieve those goals, and invest through various investment tools to accumulate financial resources to achieve the goals at each stage.

Third: Know how high your risk taking degree is

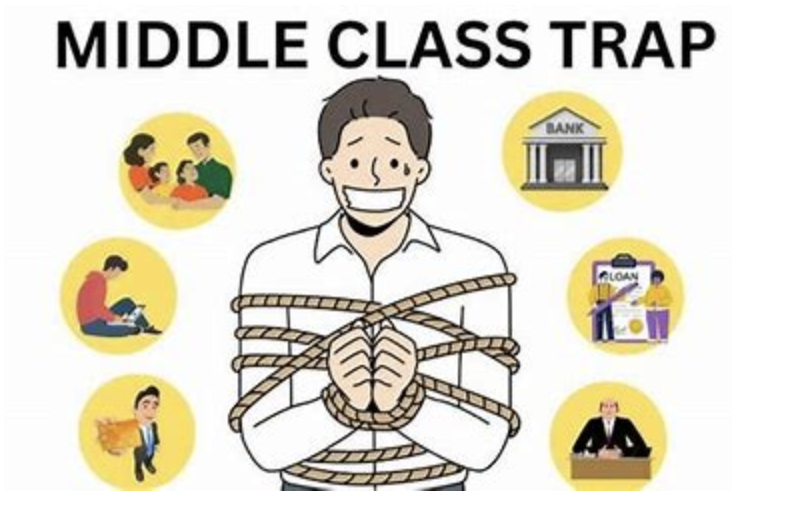

One of the key points that is often ignored in the process of financial management is the "tolerance" of risk. There will be investment behavior in the process of financial management. Since it is investment, it is necessary to face risks. Before investment, it is necessary to assess whether it can bear risks? To what extent? Because anyone will have a certain limit when taking risks. If they exceed the limit, the risk will become a pressure or burden, and even cause emotional or psychological harm.

Everyone has different degrees of risk taking. Some people are willing to pursue higher risk investments, while others are only willing to bear low risks and pursue slightly higher than the average profit. Others are unwilling to bear any risks and do not make any investment. As for the general assessment of risk, we need to consider age, income, assets, family burden, etc., so as not to let risk become a burden.

Fourth: Choose tools carefully and don't lose

In addition, various investment instruments are different in nature. Many people understand that the so-called wealth management is not the choice of high-profit investment tools, but the use of more stable investment channels and methods. More importantly, they start investing earlier than others, and use the returns generated by the effect of compound interest to accumulate wealth. The most popular fixed time and fixed investment mutual fund is the best illustration of the use of compound interest.

Fifth: The earlier the investment, the better the effect

In addition to the rate of return on investment, another decisive factor is time.

Conclusion

In financial planning, you need to clarify your own life stage and determine the relevant financial needs to properly make financial arrangements and achieve your goals.

When setting goals at each stage, there is a very important idea that these goals are the indicators of various financial actions in the future, and all the goals must be specific and feasible, because the specific goals can let you know what the real goal of financial management is.