As the world grapples with the urgent need to mitigate climate change, a transformative shift toward sustainability is driving an unprecedented boom in the green economy. Renewable energy sectors, particularly solar power and electric vehicle (EV) supply chains, are emerging as hotspots of growth, offering compelling investment opportunities for forward-thinking individuals. This article explores the untapped potential within these domains, backed by technological advancements, policy tailwinds, and evolving consumer preferences.

Solar Energy: Harnessing the Power of the Sun

Solar power has evolved from a specialized supplement to a conventional energy solution, driven by dramatic cost declines and technological advancements. Over the past decade, the cost of solar photovoltaic (PV) modules has plummeted by over 80%, making solar installations increasingly competitive with traditional fossil fuels.As per the International Energy Agency (IEA), solar power is projected to emerge as the dominant source of electricity generation by 2050, constituting nearly 30% of global supply.

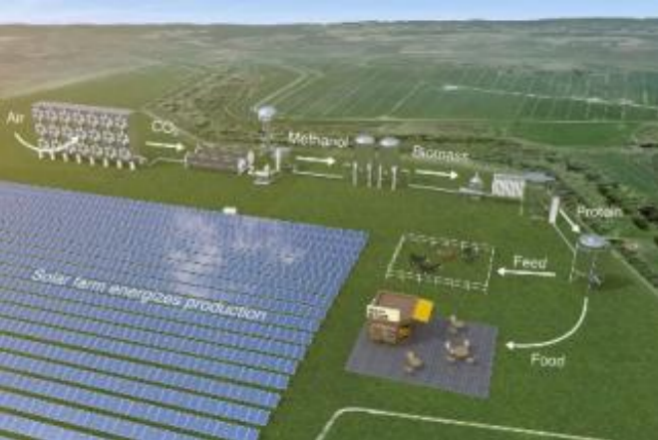

Investment opportunities in solar span the entire value chain. Upstream, manufacturers of high-efficiency solar cells and advanced materials like perovskite are driving innovation, promising even higher energy conversion rates. Midstream, project developers and engineering firms are benefiting from the rapid deployment of utility-scale solar farms and rooftop installations, especially in sun-rich regions such as the Sun Belt in the U.S. and Southern Europe. Downstream, energy storage solutions paired with solar systems—like lithium-ion batteries—are addressing intermittency challenges, creating a integrated clean energy ecosystem. Governments worldwide, through incentives like the U.S. Inflation Reduction Act and the EU's Solar Strategy, are further accelerating adoption, ensuring steady growth for decades.

EV Supply Chains: Riding the Electric Mobility Wave

Generating roughly a quarter of anthropogenic CO₂, transportation systems are rapidly adopting electrification technologies worldwide. EV sales have surged from less than 2 million in 2020 to over 14 million in 2023, and industry forecasts project that EVs will account for 50% of new car sales by 2030. This shift creates a massive demand surge across the EV supply chain, from raw material extraction to vehicle production.

Battery innovations form the foundational pillar of this evolving ecosystem. Lithium, nickel, and cobalt—key components of lithium-ion batteries—are experiencing unprecedented demand. While concerns about supply chain sustainability have emerged, advancements in battery chemistry, such as solid-state batteries and reduced cobalt usage, are addressing both performance and ethical issues. Companies involved in battery manufacturing, like Tesla, Panasonic, and European startups, are scaling up production to meet rising needs.

Beyond batteries, the EV value chain includes electric motor manufacturers, charging infrastructure providers, and semiconductor suppliers for vehicle electronics. Governments are subsidizing charging networks: the U.S. has allocated $7.5 billion for national EV charging infrastructure, while the EU aims to install 3 million public chargers by 2025. These investments not only support EV adoption but also create stable revenue streams for infrastructure companies. Additionally, software developers for battery management systems and smart grid integration are poised for growth, as EVs become part of a connected, sustainable energy network.

Beyond the Obvious: Diversified Growth Avenues

While solar and EVs take center stage, other renewable sectors offer complementary opportunities. Wind energy, particularly offshore wind farms in regions like the North Sea and U.S. East Coast, is achieving grid parity and benefiting from economies of scale. Hydrogen, though in its infancy, holds promise as a long-term energy storage and industrial fuel solution, with governments investing heavily in green hydrogen hubs. Moreover, ESG (Environmental, Social, Governance) investing has become a mainstream trend, with sustainable funds attracting record inflows. Companies demonstrating strong decarbonization strategies are increasingly outperforming their peers, reflecting investor confidence in long-term sustainability.

Seizing the Moment: Risks and Rewards

Investing in green energy is not without risks. Commodity price volatility, regulatory changes, and technological obsolescence can impact returns. The fundamental outlook remains decidedly optimistic, propelled by binding international net-zero pledges. The Paris Agreement's goal of limiting warming to 1.5°C requires trillions of dollars in clean energy investments, creating a massive market runway. For investors, diversification across sub-sectors—combining solar developers, EV battery producers, and clean tech innovators—can mitigate risks while capturing sector-wide growth.

As the green economy transitions from a niche concept to a global economic driver, the opportunities in renewable energy are both vast and varied. Solar power and EV supply chains, supported by technological breakthroughs and policy momentum, represent frontiers of innovation and financial potential. For the 20-40 age group—who will bear the brunt of climate challenges and benefit from decades of growth—allocating resources to these sectors offers not just financial returns, but also the satisfaction of contributing to a sustainable future. The time to invest in the green revolution is now: it's both an economic imperative and a chance to be part of history's largest industrial transformation.