Asset management entails a systematic process of asset design, operation, maintaining, and selling in a cost-effective manner. Everything that falls within the investment range includes stocks, bonds, property, and many other financial means. This entire process in asset management is basically to provide clients with an increase in wealth by maximizing their investment in performance while managing the potential risk. This article delves into the fundamental principles of asset management, the strategies utilized in its process, and the need for professional asset managers.

What is Asset Management?

This would be asset management, being the management of the investments of a client in the hands of a professional or a firm. A process involving strategic investment decisions based on maximizing returns on investments over the risk tolerance of a client, his or her financial goals, and the horizon of investing, while taking into account market conditions, the economic indicators, and the performing individual assets so as to build as well as maintain an investment portfolio.

Basics for Asset Management Components

Formulation of investment policy

An asset manager collaborates with the client to define a personalized policy that corresponds to the goal, which pertains to investing. A policy reflects both the investment risk and timeframe related to investment and also corresponds with the desired liquidity for funds managed.

Diversification of Portfolios

Diversification is one of the fundamental principles in asset management. The practice of spreading investments over a range of asset classes, sectors, and regions has the strategic aim of lowering risk while maximizing general portfolio performance. A diversified portfolio would lose less in declining markets but reap benefits from gains in growing markets.

Performance Monitoring and Reporting

This is the constant monitoring of the performance of an investment. Portfolio and asset managers often monitor the performance of separate assets and portfolios regularly. They update clients concerning their investments and the performing of their portfolios that is, giving them clear reports. Such transparency clarifies to clients how an investment is performing relative to a benchmark and guides decisions.

Risk Management

A good asset management system must have a sound framework for risk management. There will be different risks of markets, credit risks, and interest rate risks, among others. The asset managers measure those risks and suggest appropriate steps to mitigate such risks. It could also involve the use of stop-loss orders, hedging via derivatives, or making the necessary asset allocation adjustments considering changing market conditions.

Categories of Asset Management Services

Wealth Management

It offers wealth management for high net worth individuals and families. Such services may be as general as all-inclusive financial planning, investment management, estate planning, and tax planning-all with the view to protecting and growing the wealth in the long run.

Institutional Asset Management

The institutional asset managers are working basically with big investors like pension funds, endowments, and insurance companies. The services offered are unique since these organizations might require special asset management.

Retail Asset Management

Retail asset management is essentially a service to individual investors. It provides access to managed investment products via mutual funds and exchange traded funds (ETFs). The retail asset manager actually aims to build investment solutions accessible to wide-ranging people to assist fulfill their financial goals.

Advantages of Asset Management

Expertise and Experience

Asset managers possess substantial knowledge about the financial markets, investment strategies, and economic trends. This can enable them to give adequate, objective decision-making towards clients, which gives more success in getting the expected outcome from the investments.

Time Benefit

Investment management can be time-consuming and complex. Outsourcing it to professional’s makes way for other priorities, knowing that investments are in able hands.

Customized Financial Solutions

The asset managers, in the process of serving their clients, provide differentiated services. Thus, an asset manager gets to know the different goals as well as specific risk acceptability of different clients and accordingly frames specific investments for them within their fiscal objectives.

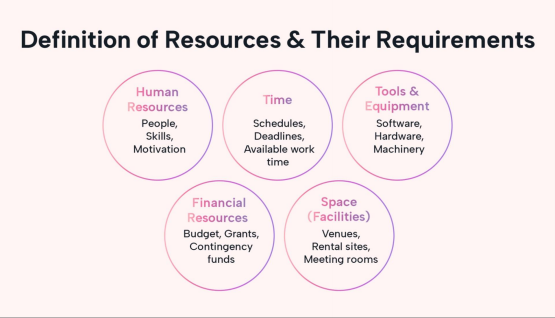

Availability of Resources and Tools

Professional asset managers have leading research, analytical models, and market information, which would not be available directly to individual investors. The professional can make data-driven investment decisions with such information.

Selecting an Asset Manager

The asset manager will make or break your financial goals. Here is what to consider:

Qualifications and Experience

Thirdly, ensure you recruit managers qualified in CFA or CFP among others. A good manager should have a record of managing portfolios similar to yours.

Fee Structure

Understand the fee structure of the asset management firm. A percentage of AUM or performance-based fees are mostly charged. Ensure that the fees are in accordance with the services and investment objectives.

Investment Philosophy

Investment philosophies differ from one asset manager to another. Always settle for a manager whose investment philosophy is aligned to your investment goals and your risk tolerance.

Client reviews and References

One should conduct a client review and testimonials to find the reputation of an asset manager. By contacting current or former clients, one is positioned in the best position to gather the most invaluable insight into the nature of the experience. By knowing the principles of asset management, types of services offered, and what the benefits are of dealing with a professional, you can make the right choice with your investment strategy. Being a high-net-worth individual or an institution searching for growth and stability in your investments, a strong asset management can truly aid in reaching your objectives financially.