In today's digital era, Web3.0 rises like a bright star, and its collision with the financial field is quietly reshaping our understanding and practice of financial core elements such as wealth management and value exchange.

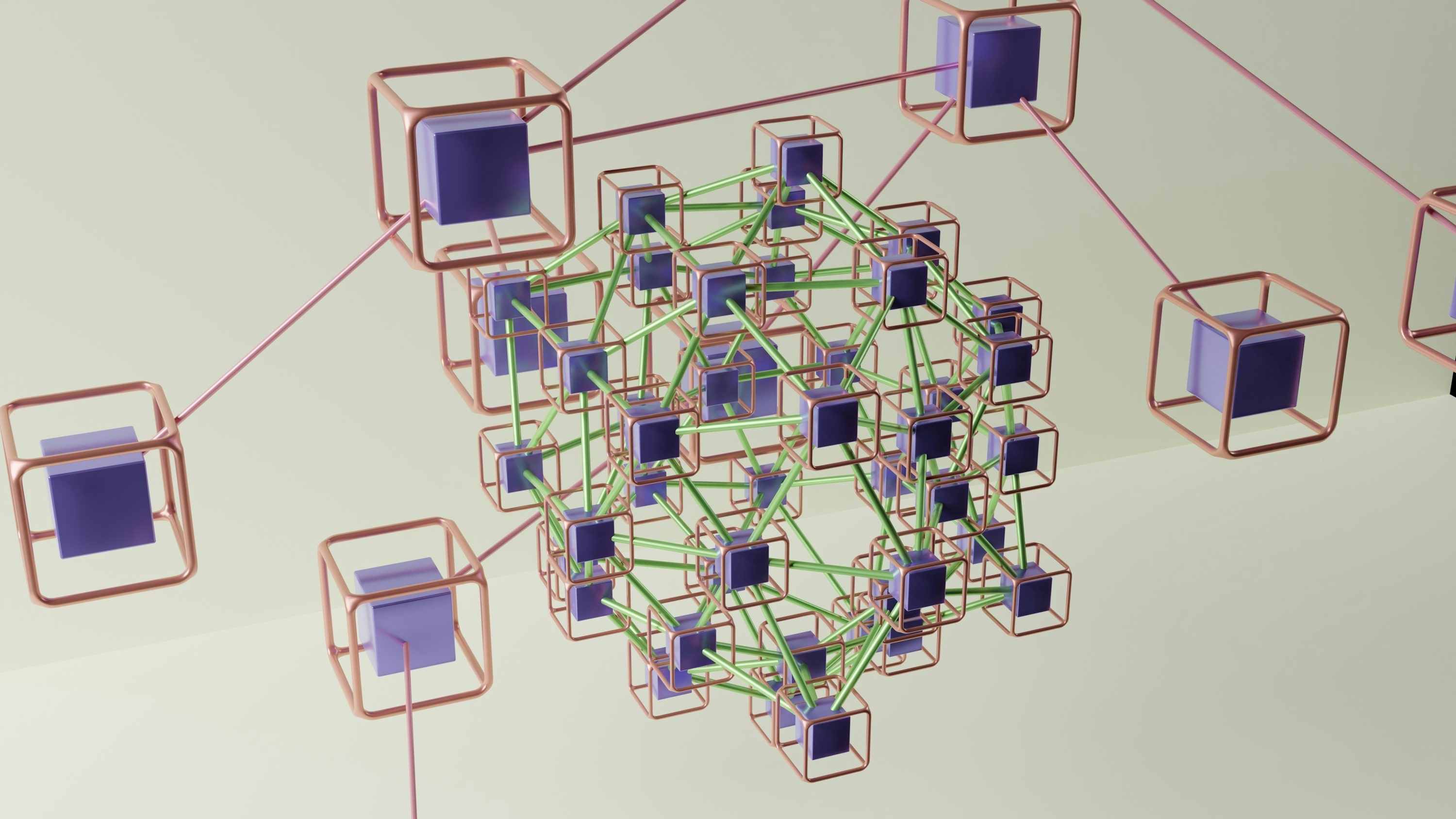

Web3.0 is based on decentralization, which is different from the centralized data storage and control mode in the traditional Web2.0 era. For the financial industry, Decentralized Finance (DeFi) came into being and became the pioneer field of the integration of Web3.0 and finance. On the DeFi platform, users no longer need to rely on the cumbersome approval process and high intermediary fees of traditional financial institutions. Under the guarantee of blockchain technology, they can directly carry out various financial activities such as lending and trading with the help of smart contracts. Smart contracts are like "guardians of integrity" in financial transactions. They automatically judge whether the two parties meet the agreed conditions according to preset rules, and once they are reached, they can quickly complete the transfer of assets, greatly improving the efficiency and transparency of transactions, making financial transactions break away from the strict restrictions of region and time, and realize 7×24 hours uninterrupted operation.

From the perspective of assets, Web3.0 gives birth to various forms of digital assets, among which cryptocurrency is the most well-known one. Bitcoin, Ethereum and other cryptocurrencies have caused ripples in the financial market, and their scarcity and verifiability make them have the potential of value storage, attracting the attention of many investors. Not only that, NFT (non-homogeneous token) also opens up new asset categories for art, collection and other fields by virtue of its uniqueness. A digital painting and a piece of music are empowered by NFT to become unique, traceable and tradable digital assets in a specific community, which brings new profit channels for creators and expands the boundaries for financial investment.

Looking at financial services again, the decentralized authentication system of Web3.0 is changing the way traditional finance authenticates users. Users are no longer bound by the cumbersome authentication requirements of multiple financial institutions, but can use the unique digital identity on the blockchain to freely shuttle between different Web3.0 financial applications and conveniently enjoy personalized financial services. Whether it is cross-border payment, wealth management or some emerging financial derivative services, they can be accurately adapted according to the user's past behavior data and asset status, improving the user experience, and at the same time making financial services more inclusive, reaching those people and regions that were marginalized by the traditional financial system.

However, the integration of Web3.0 and finance is not smooth. The regulatory problem bears the brunt, and the decentralized nature makes it difficult for traditional financial supervision methods to exert their fists and feet. How to give Web3.0 financial innovation a moderate development space while ensuring financial security and preventing risks is an urgent task for global regulators. In addition, technical risks can not be ignored, and problems such as smart contract code vulnerabilities and blockchain network attacks may cause huge losses of financial assets once they occur, which will have an impact on the entire financial ecology.

Looking forward to the future from the present, the road of integration of Web3.0 and finance is full of challenges but also infinite opportunities. It is expected to completely subvert the traditional financial structure and reshape the global financial order. Let us witness this highly revolutionary process together.