For people in their 30s who earn a lot, retirement may feel far away. However, beginning to save smartly now is essential for a future without worries. In addition to standard retirement plans, there are advanced strategies designed for those with high incomes, which help secure their finances and maintain a comfortable lifestyle after they stop working.

Leveraging High-End Retirement Accounts

Although 401(k)s and IRAs are widely used, wealthy individuals in their 30s may want to consider more specialized options for retirement savings. Self-Directed Solo 401(k)s, which are designed for people who work for themselves, have higher limits on contributions than traditional accounts. Freelancers or entrepreneurs with significant earnings can contribute as both an employee and an employer, allowing them to save over $60,000 each year. In addition, Roth 401(k)s allow you to take out money tax-free once you retire, which helps people who expect to have a higher tax rate later on. By utilizing these advanced financial options, affluent individuals can significantly boost their retirement savings right from the start.

Alternative Investments for Long-Term Growth

Instead of depending only on stocks and bonds, think about exploring alternative investments to widen your retirement portfolio. Private equity funds that target growing industries like fintech or biotech may deliver significant returns over time. Those who earn a lot and are willing to take risks can set aside some of their savings for these funds, utilizing the knowledge of expert fund managers. You could look into real estate crowdfunding as an option.This enables you to purchase luxury properties without needing to pay a large sum initially.The rental income generated from these properties can ensure a regular flow of passive income during retirement, adding to your other savings.

Tax-Efficient Strategies for Maximum Savings

Taxes can significantly reduce your retirement savings; however, there are strategies to lessen their effect. Wealthy individuals have the option to create a Donor-Advised Fund (DAF). Contributing to a DAF provides you with an instant tax deduction, and these funds can be allocated to charities gradually. This approach not only decreases your current tax obligations but also enables thoughtful charitable giving, contributing to your legacy planning. Moreover, employing tax-loss harvesting in your investment portfolio helps balance out capital gains, effectively lowering your total tax liability and allowing you to save more for retirement.

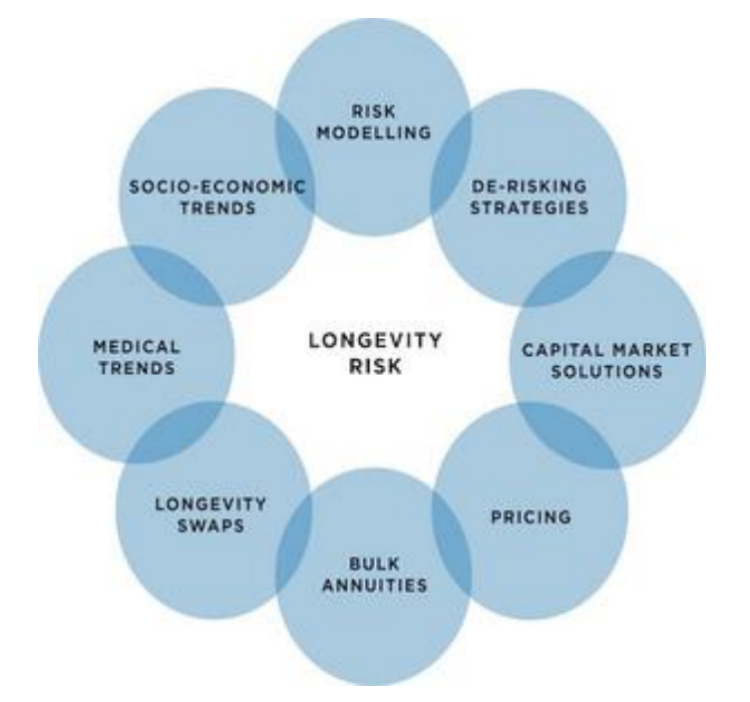

Incorporating Longevity Risk Management

As people live longer, the risk of outlasting one’s savings—known as longevity risk—has grown increasingly important. One way to tackle this problem is through annuities. For example, deferred income annuities can offer a steady income that begins at a certain age, usually during the later stages of retirement. Those who earn a high income can benefit from these annuities by building a solid financial base, guaranteeing they will receive income even if they reach their 90s or older. This thoughtful method of handling longevity risk offers reassurance and financial stability during retirement years.

Building a Legacy While Saving for Retirement

For wealthy individuals, planning for retirement involves more than just securing their finances; it also presents a chance to create a meaningful legacy. Establishing a trust fund early can assist in transferring your wealth to future generations while lowering tax responsibilities.You can use irrevocable life insurance trusts (ILITs) to manage your life insurance policies, safeguarding the benefits from estate taxes and ensuring they are allocated as you intend. By incorporating legacy planning into your retirement strategy by the age of 30, you can positively influence your family and community while enjoying a fulfilling retirement.

To sum up, beginning retirement savings at 30 is a wise decision for those with high incomes. By utilizing sophisticated retirement accounts, investigating different investment options, applying tax-smart methods, addressing longevity concerns, and focusing on legacy, you can secure a stress-free retirement and a stable financial future. With the right strategies in place, you can reap the rewards of your hard work now and during your later years.