Instructing children from affluent backgrounds about how to manage money is not just about preventing excessive spending; it also helps develop essential life skills. Begin with practical budgeting: provide them with weekly allowances and encourage them to allocate their money toward wants, needs, and savings. Organize a "family charity project" where they can research different causes and decide how much to donate, which helps cultivate empathy. Incorporating games such as simulated stock exchanges or business scenarios can introduce them to basic investment concepts. Promote earning by assigning small chores, establishing a connection between effort and value. Make it a habit to talk about financial decisions, prompting them to reflect with questions like, "Do we really need this or is it just a desire?" These methods encourage responsibility, enhance critical thinking, and foster an understanding of money's value beyond mere spending, laying a groundwork for financial literacy that lasts a lifetime.

Immerse in Real - World Financial Projects

Go beyond just teaching financial concepts and engage children in real-life projects about money. For example, you could buy a small business property or invest in a startup together with your child. Allow them to take part in activities like market research, property tours, or meetings with business owners. By participating directly, they will see how people make investment choices, assess risks, and earn profits. This practical experience will help them grasp how the financial world works, rather than only studying it from books.

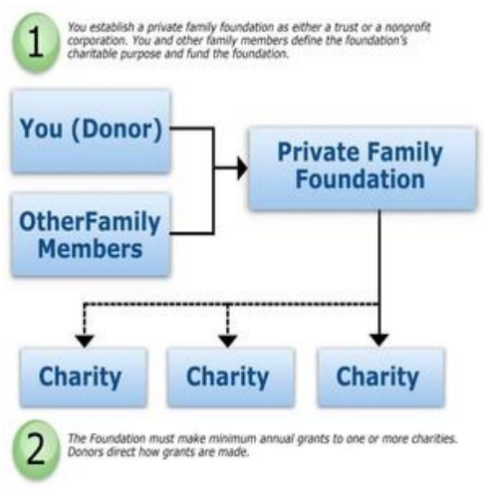

Create a Family Philanthropy Fund

Start by creating a family philanthropy fund together with your kids to explore social impact investing. Talk about various important causes like protecting the environment, helping those in poverty, or supporting education. Allow your children to look into different charities, check how financially clear they are, and choose which projects to support through voting. This experience will teach them the significance of money in making positive changes, highlight the need for careful research, and encourage feelings of empathy and social responsibility at the same time.

Host Financial Role - Playing Games with a Twist

Classic money-counting games can evolve into advanced simulations. Create games that allow kids to handle a “mini-portfolio” with stocks, bonds, and commodities. Utilize up-to-date financial information from trustworthy sources to enhance realism. Furthermore, include components like market disruptions, economic news, and competitor tactics. These engaging games will not only introduce fundamental financial ideas but also support children in building skills in risk management and strategic thinking while having fun.

Leverage High - End Financial Education Resources

Utilize specialized financial education platforms, workshops, and mentoring programs. Sign your children up for private courses on financial literacy led by experts in the field, allowing them to engage with accomplished investors and business owners. Get subscriptions to premium financial magazines and digital platforms designed for young investors that deliver detailed analysis and investment examples suitable for their age. These top-tier resources create a richer and more professional learning atmosphere, speeding up your children’s financial development.

Ultimately, providing financial knowledge for children from wealthy families involves a mix of practical experiences, creative teaching styles, and access to quality materials. By implementing these distinctive strategies, you can enable your children to become knowledgeable about finances, giving them the skills to confidently navigate the complex world of economics.