In the investment landscape, Exchange-Traded Funds (ETFs) have become an attractive choice, particularly for those who spend a lot and want a combination of ease, variety, and possible profits. However, are ETFs genuinely a low-risk, hands-off method to earn money? Let's explore this further.

Understanding the Basics of ETFs

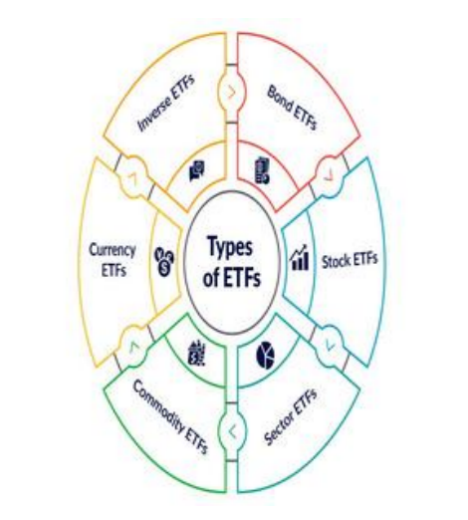

ETFs are investment funds that follow the performance of an index, a commodity, a collection of assets, or a particular investment method. They are different from mutual funds because they are bought and sold on stock exchanges all day long, similar to regular stocks. This ability gives wealthy investors the option to buy or sell whenever the market is open. For example, if you are interested in the technology sector, you can choose a technology-focused ETF. This lets you invest in a variety of tech firms, from well-known leaders to new startups, without needing to select individual stocks.

Diversification at Its Core

One major reason why ETFs are viewed as low-risk investment options is their built-in diversification. Typically, ETFs contain a wide range of assets. For instance, an ETF that follows a broad market index like the S&P 500 includes stocks from 500 different companies in various industries. This diversity helps to reduce risk. If one company in the ETF performs poorly, the overall value of the ETF will probably not be affected much since the other 499 companies may still do well. Wealthy individuals, who usually want to safeguard their significant assets, can greatly take advantage of this way of minimizing risk.

Lower Volatility Compared to Individual Stocks

ETFs usually bring less volatility compared to individual stocks since they spread investments over various assets, which helps to reduce sharp price fluctuations. This consistent performance attracts wealthy investors who are cautious about risk and have long-term objectives, as the values of ETFs are not as likely to drop sharply during market declines, offering them more reassurance.

Dividend-Paying ETFs

Numerous ETFs focus on stocks that pay dividends, allowing investors to receive a share of those dividends from the companies they own. Certain ETFs that target high dividend yields provide consistent income, which wealthy individuals can either reinvest for compounded growth or use to cover their living expenses, thereby increasing the overall income of their portfolios.

Bond ETFs for Steady Income

Bond ETFs offer a steady stream of passive income through investments in government, corporate, or municipal bonds, which send interest payments to investors. Generally, these funds are more stable than those based on stocks, providing a low-risk way to earn income that helps preserve capital while still yielding returns.

Global Thematic ETFs

Wealthy investors can explore worldwide trends using thematic ETFs that concentrate on areas like clean energy, e-commerce in emerging markets, or artificial intelligence. These options help them join in the long-term development of innovative trends. For instance, clean energy ETFs provide a chance to benefit from the worldwide move towards renewable energy sources.

Leveraged and Inverse ETFs

Leveraged ETFs seek to enhance daily returns of an index, while inverse ETFs perform in the opposite direction of these indices. These investment options, while intricate and risky, can give knowledgeable investors a chance to boost their profits or protect against market declines. However, it is crucial to proceed with great care due to the increased volatility and the risk of substantial losses.ETFs serve as a low-risk way for those with high expenses to earn passive income. By utilizing diversification, options that focus on income, and smart thematic investments—with the right research or advice—investors can create varied and growth-focused portfolios that match their financial objectives.