Among people who have a lot of money to spend, careful spending is frequently confused with just being cheap. However, it actually reflects an advanced skill in managing wealth that is much deeper than simple limits on how much one spends. Thoughtful purchasing isn’t about missing out on life’s joys; instead, it focuses on making smart decisions that improve long-term financial health and overall happiness.

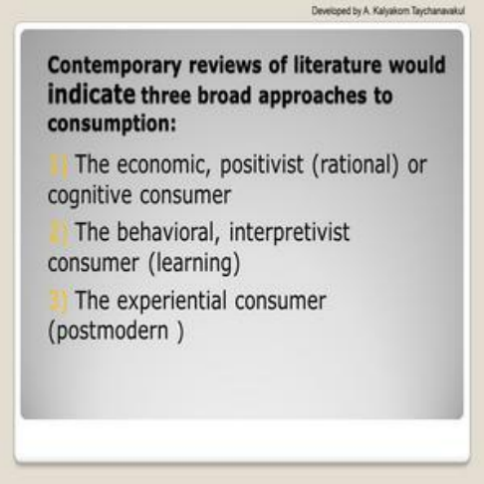

The Cognitive Psychology Behind Rational Consumption

Spending wisely is closely linked to cognitive psychology. People who spend a lot often face many marketing messages aimed at making them buy things on impulse. In contrast, those skilled in rational spending know how to keep their feelings in check. They can distinguish between true needs and short-lived wants by using strategies like the "72-hour rule," which involves waiting for three days before making a purchase. This waiting period helps them decide if the item fits with their long-term financial goals and personal beliefs.

Additionally, mindful spenders grasp the idea of "opportunity cost." Every time they buy something, they make a choice about where to use their money, and understanding what other things they could do with those funds leads to more thoughtful choices. For example, rather than quickly purchasing an expensive watch, they may reflect on how that money could be invested to earn passive income or used for education that boosts their career potential.

Rational Spending as a Tool for Wealth Preservation and Growth

Smart spending is essential for maintaining and growing wealth. Individuals who spend a lot can make better choices by avoiding paying too much for things that lose value. Rather than rushing after the newest fashion or tech items, they choose to put their money into assets that will appreciate, like fine art, real estate, or well-crafted collectibles that maintain or increase their value over time.

In addition, wise spending helps with effective financial planning. It allows people to save money for unexpected expenses, retirement, and other future financial aims. By managing their optional expenses, they build a financial cushion that safeguards their wealth during tough economic times and provides the opportunity to invest when chances come along.

The Social Capital of Rational Spending

Thoughtful spending significantly influences social capital. In elite groups, where flashy purchases are common, showing smart spending habits can garner admiration and respect. It reflects wisdom in finances, self-control, and a focus on the future. Individuals who spend wisely are more inclined to have insightful discussions about investments, financial management, and wealth growth, leading to valuable connections and possible business partnerships.

Moreover, wise spending can inspire family and friends, positively affecting their financial choices. By valuing experiences over physical items, they promote a more rewarding and sustainable way of living, enhancing relationships and creating cherished memories.In summary, thoughtful spending is an essential skill that combines mental discipline, strategic finance, and social impact. For those with high expenditures, learning to spend sensibly goes beyond money management; it's about laying the groundwork for enduring financial success, personal satisfaction, and social reputation.