The space economy has evolved from science fiction to a $469 billion industry (per 2024 Space Foundation data), with space tourism emerging as a high-growth segment that captivates Western adults aged 20-40. This demographic—digitally savvy, risk-tolerant, and eager to invest in “future-defining” sectors—views companies like Virgin Galactic and Blue Origin not just as novelty plays, but as potential drivers of long-term returns. Yet while space tourism’s investment allure is undeniable, its unique business models and financial challenges demand a nuanced understanding for young investors navigating this frontier.

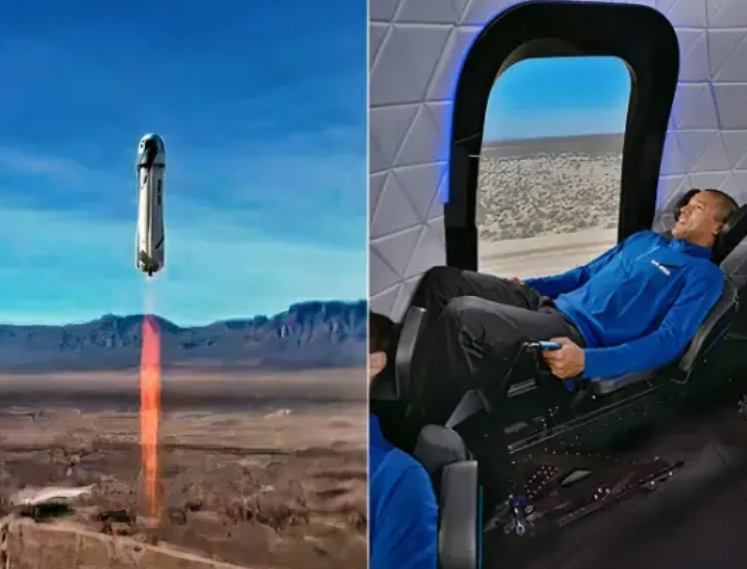

Virgin Galactic and Blue Origin have pioneered distinct commercial strategies to tap into space tourism’s demand. Virgin Galactic focuses on suborbital experiential travel, offering 90-minute flights that let passengers float in zero gravity and view Earth’s curvature. Its business model relies on a membership-tiered system: a $1,000 initial deposit secures a spot, with the full $450,000 ticket price due before launch. By 2024, it had over 800 confirmed bookings, plus partnerships with luxury travel firms (e.g., Virtuoso) to target high-net-worth millennials. Blue Origin, meanwhile, leans into private suborbital jaunts via its New Shepard rocket, with tickets priced at $250,000–$300,000 and a focus on customization (e.g., private flights for families or corporate teams). Both firms also pursue ancillary revenue: Virgin Galactic’s research division sells suborbital lab time to pharmaceutical companies, while Blue Origin licenses its rocket technology to satellite firms—diversifying income streams that appeal to young investors seeking stability amid volatility.

For investors aged 20-40, space tourism offers unique upside. Morgan Stanley predicts the sector could reach $13 billion by 2030, driven by rising demand for “bucket-list” experiences and technological cost reductions. Publicly traded options like Virgin Galactic (NYSE: SPCE) let retail investors access the sector with low entry points (share prices around $5–$7 in 2024), while private equity funds (e.g., Space Capital) offer exposure to early-stage firms. Young investors, who prioritize ESG and innovation, also value these companies’ spillover benefits: Blue Origin’s reusable rockets reduce space debris, aligning with sustainability goals that 73% of EU under-40s cite as an investment factor (2024 Eurostat poll).

Yet significant financial challenges persist. High capital expenditure is a core barrier: Virgin Galactic spent $280 million on research and development (R&D) in 2023 alone, while Blue Origin’s New Shepard program has cost over $1 billion to develop. Profitability remains elusive—Virgin Galactic reported a $156 million net loss in 2023, and Blue Origin has yet to turn a profit—creating volatility that tests young investors’ risk tolerance. Regulatory fragmentation adds another layer: the U.S. FAA oversees launches, but the EU’s upcoming Space Traffic Management Regulation (2026) will impose new compliance costs, increasing operational uncertainty. Additionally, ticket prices remain prohibitive for most consumers, limiting near-term revenue growth and raising questions about market scalability.

For Western adults aged 20-40, space tourism represents a compelling blend of innovation and investment potential—but not without caveats. Those willing to weather short-term volatility may benefit from the sector’s long-term expansion, while others may prefer diversified exposure via broader space ETFs (e.g., ARK Space Exploration & Innovation ETF). As Virgin Galactic and Blue Origin refine their models, the key for young investors will be balancing enthusiasm for the future with a clear-eyed assessment of the financial hurdles that still lie between space tourism and mainstream profitability.