For wealthy investors, the act of "pursuing increasing prices and disposing of diminishing prices" is more than just a poor decision; it involves a mix of biological factors, market structure, and cognitive limitations. To escape this pattern, it is crucial to identify its concealed triggers instead of merely resisting temptations.

Financial successes activate the brain’s reward centers similarly to a drug. As asset values rise, dopamine surges into the prefrontal cortex, impairing risk evaluation. This reaction is rooted in neurochemistry, not greed. Individuals with high incomes frequently fall victim to this because their achievements condition them to rely on "winning streaks."

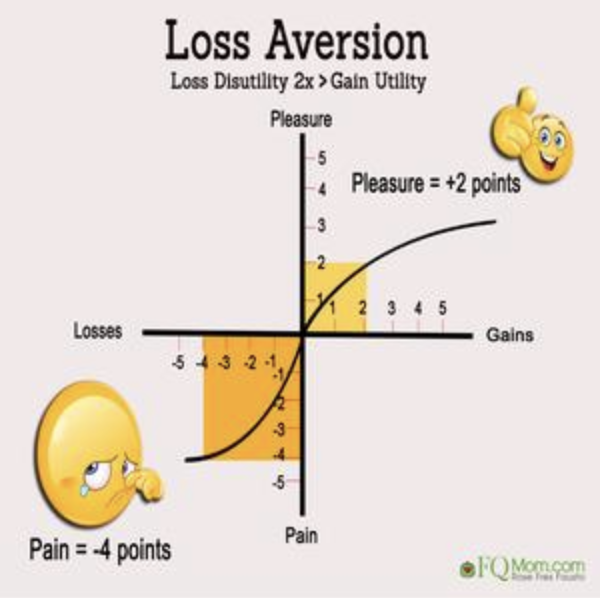

Loss Aversion’s Distorted Math

People experience losses with double the intensity compared to gains. When markets decline, the fear of additional losses leads to panic selling, even when the underlying fundamentals are robust. Wealthy investors might react excessively to safeguard their wealth, converting temporary downturns into enduring losses.

Social Proof in Elite Circles

Networks of high-net-worth individuals amplify the tendency to follow the crowd. Hearing peers talk about “outperforming the market” can fuel feelings of missing out, while silence around losses conceals the consequences of such pursuits. Exclusive groups and private forums can inadvertently make reckless timing appear acceptable.

For wealthy investors, this social validation transforms elite circles into reinforcing chambers of risk. A private equity opportunity praised by peers in a members-only group may lead to rushed investments, even when due diligence reveals concerns—simply because “everyone is involved.” Compounding the issue, the taboo against discussing losses prevents investors from seeing the complete scenario: one person's "market-beating" cryptocurrency profit overshadows the quiet withdrawal of others who faced significant losses. This skewed social feedback normalizes rash actions, making trusted circles unwitting supporters of diminishing wealth.

Algorithmic Feeds Reinforce Bias

Platforms such as social media and financial applications favor volatile assets, as they enhance user engagement. Your social feed emphasizes rapidly rising stocks while overlooking consistently performing assets, creating a misleading impression of “missed chances.” This algorithmically driven echo chamber skews the perception of the market.

A history of success fosters a confidence that spills over into investment activities. Executives accustomed to managing their outcomes find it challenging to navigate market uncertainty, prompting them to "time" the highs and lows—confusing skill for luck based on prior returns.

In the absence of established guidelines, emotions take control. High earners often neglect to develop exit strategies, believing they will intuitively know when to sell. This uncertainty allows short-term fluctuations to overshadow long-term objectives, shifting discipline into impulsive actions.

The Illusion of “Special Information”

Having access to exclusive insights or insider circles can foster overconfidence. Investors may confuse anecdotal evidence with actual data, pursuing investments based on “hints” rather than thorough investigation. This misplaced advantage intensifies the cycle of buying at high prices and selling at low prices.

Breaking this cycle necessitates creating systems that combat biological impulses: establishing preset guidelines, diversifying investment portfolios, and isolating financial decisions from social influences. Success hinges not on intellect but on outsmarting one's own brain.