For individuals with substantial wealth and international assets, conventional domestic insurance systems are inadequate. The current fluid global insurance landscape provides customized solutions that safeguard wealth across borders while also creating exceptional opportunities, making it essential for international financial strategies.

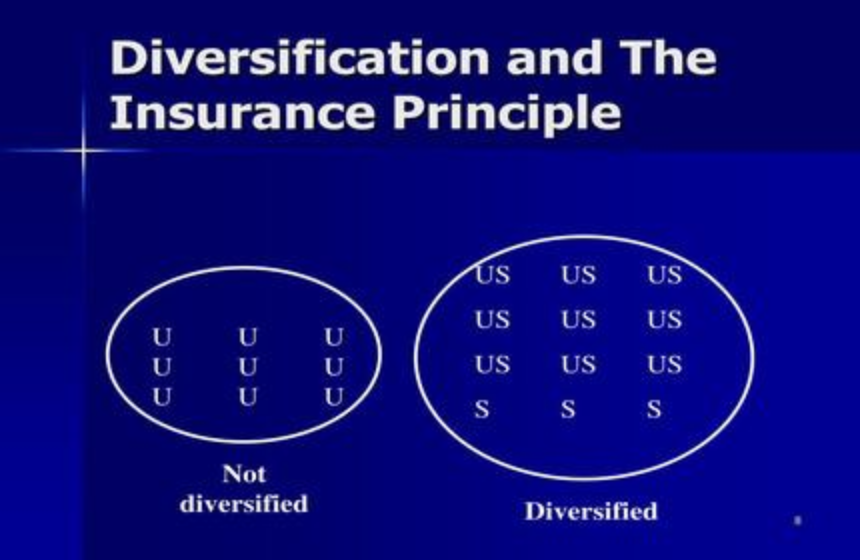

Jurisdictional Diversification for Stability

Selecting insurance providers from various reliable jurisdictions reduces the risks associated with changes in regulations or economic volatility in a single country. For instance, obtaining a policy from a European Union insurer alongside one from a stable Asian market establishes a protective layer. This strategy guarantees that coverage remains effective, even when local policies encounter unforeseen limitations.

Currency Risk Hedging via Insurance

Variations in currency exchange rates can diminish the worth of insurance payouts. Specialized international policies permit benefits to be expressed in several currencies, including USD, EUR, and GBP. This enables beneficiaries to receive funds in the currency that best suits their requirements, protecting them from losses due to unfavorable exchange rate shifts during claim settlements.

Moreover, these global regulations can improve asset security by utilizing the legal systems of foreign regions, safeguarding money from possible creditors or legal actions in certain situations. They also provide adaptability for those living an international lifestyle, permitting multi-currency options to reduce the risks associated with currency exchange and meet various financial requirements across multiple nations.

Coverage for Global Lifestyle Assets

Individuals with global ties frequently possess assets such as international real estate, luxury aircraft, or yachts. Standard insurance policies may not cover overseas usage or could have restricted coverage. Global insurance solutions provide uninterrupted protection across different countries, including emergency repairs for luxury boats in isolated areas or liability insurance for rental properties abroad.

Additionally, these tailored policies frequently feature customized risk evaluations that consider local specifics—such as regional rules governing property insurance in Europe or maritime regulations for boats in the Caribbean. This degree of personalization guarantees that valuable international assets are protected from risks unique to their locations that standard policies may miss, offering reassurance to owners of assets across borders.

Tax-optimized International Policies

Certain offshore insurance configurations, when aligned with global tax regulations like CRS, can offer tax benefits. For example, policies established in tax-friendly jurisdictions can provide tax-deferred growth on cash values or lessen inheritance tax obligations in designated areas. Collaborating with experts knowledgeable in both insurance and international tax is vital for compliance.

Moreover, these global regulations can improve asset security by utilizing the legal systems of foreign regions, safeguarding money from possible creditors or legal actions in certain situations. They also provide adaptability for those living an international lifestyle, permitting multi-currency options to reduce the risks associated with currency exchange and meet various financial requirements across multiple nations.

Healthcare Access Across Borders

Affluent individuals seek premium healthcare services without borders. International health insurance plans offer access to a network of top hospitals and specialists across different continents, with direct billing processes that avoid upfront costs. These policies also cover medical evacuation, guaranteeing prompt medical attention even in remote regions.

Cross-border insurance needs to work in conjunction with international estate planning instruments like trusts or foundations. For example, a life insurance policy held within an offshore trust can enable swift asset transfer to heirs in various countries, circumventing lengthy probate procedures in multiple jurisdictions while maintaining the estate’s value.