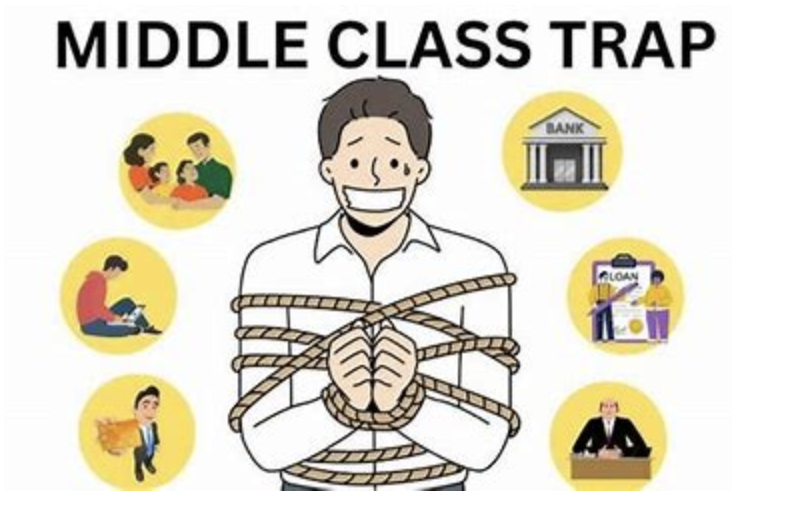

Many families with high earnings and significant assets believe they are financially stable; however, the most considerable danger often resides in their debt arrangements. Unlike clear cash flow issues, poorly constructed debt strategies gradually diminish wealth, taking advantage of the middle class's misplaced confidence in reliable revenues and increasing asset values.

The Illusion of Diversified Liabilities

Spreading out assets is a common tactic, yet many fail to recognize the risks associated with uneven debts. Balancing various credit accounts, personal loans, and secured funding can lead to a complex situation, where missing a payment on one can result in a series of penalties. Additionally, different lenders adopt distinct methods for calculating interest and late fees, complicating the ability to accurately assess total costs until financial strain arises.

Households that spend heavily often utilize borrowing to obtain luxury items or investment properties, yet few synchronize their debt conditions with the volatility of their assets. For example, a second home financed through a short-term loan becomes quite vulnerable if the property market declines. Unlike affluent individuals who possess extra assets as a buffer, the middle class tends to lack the flexibility needed to weather such downturns, transforming manageable debt into a crisis situation.

Invisible Debt from Lifestyle Inflation

Lifestyle inflation generates concealed liabilities that evade conventional risk evaluations. Memberships to exclusive clubs, installment agreements for premium electronics, and deferred payment plans accumulate into consistent debts. While these individual commitments may seem minor, they gradually diminish disposable income, resulting in less capacity to manage significant obligations such as mortgages during fluctuations in earnings.

Maturity Mismatch: A Latent Bomb

Aligning the duration of debt with the lifespan of assets is vital but seldom emphasized. Opting for short-term personal loans to fund long-term projects, like home improvements or education, results in a timing discrepancy. When these loans come due, if the investments have not provided anticipated returns, families may have no choice but to sell assets at lower prices or incur higher-interest obligations for refinancing purposes.

Borrowers often perceive collateralized loans as “safer,” yet they come with particular hazards. Using a primary residence or investment portfolio as collateral raises the risk of exposure to market declines. A fall in asset prices might lead to margin calls or necessitate liquidation, wiping out years of accrued wealth. In contrast to unsecured debts, collateralized loans put essential assets in direct jeopardy.

Regulatory Shifts and Debt Vulnerability

Changes in financial regulations can unexpectedly modify the costs of debt. Adjustments in interest rate strategies, lending criteria, or tax policies regarding debt can disturb well-crafted repayment plans. Middle-class families, who are less capable than larger institutions in mitigating regulatory risks, may experience sudden increases in their monthly payments or find refinancing options disappearing overnight.

To address these risks, it is essential to reconsider the structure of debt rather than merely cutting down on total borrowing. Focusing on aligning terms, simplifying obligations, and developing buffers for market and regulatory changes can help protect wealth. For households that spend significantly, financial safety is found not in the size of their income but in the robustness of their debt management framework.