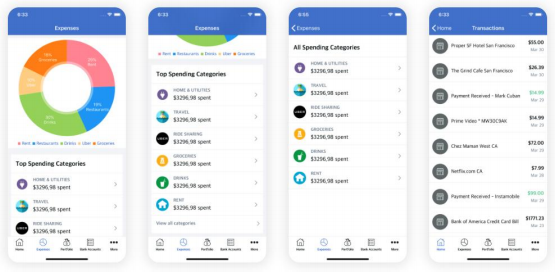

Budgeting apps have become integral to personal finance management, tracking spending, and mapping financial goals. These apps help individuals understand their spending habits, create budgets, and save more effectively all usually through smartphones. Below is a rundown of popular budgeting apps and their features that make them useful for myriad financial goals.

Top Budgeting Apps and Their Key Features

Mint: Mint is a friendly free app that has presented an all-inclusive look at the finances. The application connects all your accounts with banks, credit cards, and other financial establishments automatically categorizing your transactions for you to track real-time expenses. Mint lets people set budgets, create monetary goals, remind them about bill payments, and tracks your credit scores.

PocketGuard: The application focuses more on its ability not to overspend. PocketGuard analyzes and tracks income, bills, and spending; then returns, giving the reader the saved amount for discretionary spendings. Its "In My Pocket" feature calculates the amount that can safely be spent for users minus regular bills and savings goals.

Goodbudget: This app is "envelope budgeting" application. Users allocate segments of their income to particular categories, or "envelopes," and they then spend from them. Goodbudget does not integrate with the bank accounts. It has to be typed manually. It is the perfect application for those people who like hands-on monitoring. It is also apt for couples and families. One can use several devices under the same budget.

Why Use Budgeting Apps?

Goal Setting and Savings: Many budgeting apps allow for features that will help create goals and save for things like vacation, emergency fund, or down payments on a house. This feature, however, is only particularly helpful to users who know exactly what they are trying to save for.

Debt Management: Apps like YNAB and EveryDollar offer debt resources. Because of their expense tracking and budgeting aspects, users will have ample opportunity to place money in a manner that can bring about quicker independence from debts.

Data Security: Since the budgeting apps connect one's sensitive financial data, these apps usually employ bank-level encryption and secure authentication procedures, for example, two-factor authentication, to protect personal information. This way, privacy and security are well maintained while managing personal funds.

Selecting the Correct Budgeting App

What is the best budgeting app? It depends upon personal financial goals, one's comfort level with tracking, and preferred budgeting methods. Here are a few tips for selecting a budgeting app:

Compare Price of Subscriptions: A lot of budgeting applications have free versions which work with simple features, as well as paid for subscription versions with advanced tools. For example, YNAB has a month-by-month fee or an annual fee, but this gives users very advanced tools they can utilize if needed. They shall be integrated and require considering integration needs since some access directly to a bank's account, credit card accounts, and loan accounts directly while others would require re-entry. Direct access integration with financial institutions saves and avoids time waste while they ensure accuracy in entry hence coming with some subscription costs.

Secondary Features: Credit score reporting, investment tracking, debt reduction tools may be great depending on your situation; Mint offers credit score reports, while YNAB is more of a strict budgeting and saving method.

Best Practices for the Use of Budgeting Applications

To make the best use of budgeting apps, here are some ideas:

Review Goals Often: Financial goals change often, so it's best to update them as soon as possible in the app. Most apps allow for modification or addition of savings and budgeting goals.

Monitor the App Frequently: The more one checks the app, the less likely one is to overspend and get financial goals back on track. It can be done at weekly or monthly intervals and help to know where spending money is going and how adjustments should be made.

Classify Expenses Wisely: For one to determine correctly what one spends his or her money on, he or she must classify it correctly. Some applications have special categories for one to go ahead and categorize them in depth.

Budget through Reports: The most essential budgeting application would present one with reports every week or month. Going through the reports gives an area of reduction and possibly adding more savings.

Top Budgeting Apps Depending on Goals

• Best Budgeting Application for a First-Time User: Mint

• Best Budgeting Application for Proactive User: YNAB

• Best for Avoiding Overspending: PocketGuard

• Best to Pay off Debt: EveryDollar

• Best for Families or Couples: Goodbudget

Conclusion:

With the rise of budgeting applications, managing finances has reached its simplest form: just log in and track what is spent, save what could be saved, or keep working towards that perfect, dreamt-of milestone toward financial freedom. This goes from paying off existing debt to saving for something long-awaited or just putting it all together so the rest of your life falls under a better financial perspective and management. Choose that most appropriate app for you regarding your personal finance need and get ready to walk in the right direction towards greater budgeting and enhanced wellness in your finances.