For people with consistent of considerable purchase, get loans for gross items such as cars, house or waivers can they appear simple financial handle. However, under the surface are complex risks that can also disrupt the most scheduled financial portfolios. The understanding of these less popular threats is essential before they participate in a large loan.

The Hidden Asset Concentration Risk

When investing an important part of wealth in a single property as a luxury car or high, there is a hiding risk of concentration of the asset. Alts individuals - RET - often worthy of their investment portfolies, but loans may distort this balance. For example, if a hypotacy means a mortgage can relate to your net value to a single realmobile, each slowdown in the lighter market may disproportive your general financial health. This risk is Consisting of the fact that real estate and cars are non -otal assets; Conversion in species quickly involves acceptance of significant losses often.

more, in the case of many borrows for different assents - to say, a car loan and a rinet loan - you can't know - explain in a specific sector. An unexpected economic shock in the consumer's market or sustainable accommodation can leave in a financial of tangible, despite your High-income status.

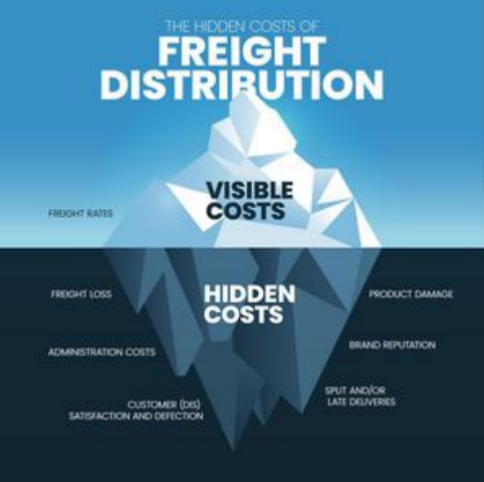

The Labyrinth of Hidden Costs

Loans are carried with abundance of hidden costs that exceeds the director and interest. For home buyers are often thoroughly linked to the immobilium, title search and legal grant. In Unace regions, they can tax or additional sample tax on high properties of value that are not immediately visible. These costs can add a significant percentage to the full amount of the loan, increasing financial load.

as to loading loans, luxury Vehicles often have higher insurance prizes, maintenance costs and depreciation levels. A high-tip car may be depreciated by a much faster tax that expected, leaving "in the loan, where the vehicle's value is lower. For renewing loans, the unpredictable structural problems or construction changes may lead to the exceeding cost, which place an additional pressure on your finances.

Interest Rate and Refinancing Pitfalls

The high income can assume that they are secure from fluctuations in interest, but is a false dangerous idea. Variable rate loans, commonly used for the car hippos and loans of car, can explain the increasing loans of the unexpected rate. Even an increase in interest rate may result in a significant increase in monthly payments during the life of a long-term loan.Refining, often responded as a solution for high interest loans, has their risks. Longers can pay prepaid ends For the refund of old loans, and the refinancing process is causing costs. Also, if the market conditions vary individually during the refinancing process, you can end with the less conditions - ideal credit.

The Lifestyle Creep Trap

PROVIDE PERSONS FOR THE Dear Axis can in detail changes of living habits and expenditure habits. Have a car at home or luxury can lead to a "lifestyle", where you start to move more about the expenses connectors as the art armor or car or car This increase in discrusting expense can last your finances, especially if your income receives a sudden shot.

in addition, psychological pressure to maintain a certain level of life With these assets can lead to a loan. You can find yourself get more you can you can be quiet, all maintenance names in an imposed image of life.

In conclusion, although loans can facilitate the acquisition of desirable assets, people at high expense should be very aware of these hidden risks. View, Angeling and plays these meninues less visible deeply in depth, you can make more financial decisions from more education and Save your long - Long -term Long -ter Financial.