In the shining realm of online wealth, NFTs and digital assets have drawn in wealthy investors with their claims of creating new value. For individuals with substantial wealth who are skilled at spotting new opportunities, these digital tokens—covering everything from art to virtual property—offer an attractive mix of technology and possible profits. However, behind the flashy sales and famous endorsements, there is a complicated scene that requires careful and thoughtful evaluation, especially for those putting a lot of money into this new type of asset.

The Elusive Nature of Digital Intrinsic Value

Digital assets differ from traditional investments, which have clear cash flows or practical uses, as their value relies on a delicate mix of perception, rarity, and collective agreement. While a painting’s price may come from the artist’s fame and visual appeal, the value of an NFT depends on less tangible factors, such as the strength of its community, the reliability of its platform, and its significance in culture. This presents a distinctive challenge for savvy investors, as standard valuation tools like discounted cash flow or earnings multiples don’t fit.

Another important risk to consider is "platform dependency." Most NFTs are tied to certain blockchains or specific digital environments, making their value and accessibility dependent on the ongoing success and existence of these platforms. In contrast to physical artwork that maintains its value regardless of medium, a digital asset can lose its worth if the underlying technology changes or if its platform fails. Wealthy investors should be aware that they are frequently investing in both the asset and the unstable system that supports it, a dual risk often overlooked in the excitement surrounding digital collectibles.

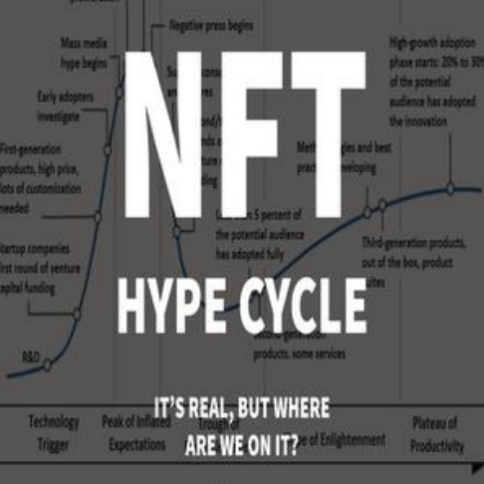

Market Dynamics: Hype vs. Sustainable Demand

The fluctuations in NFT prices are driven by excitement rather than real worth—values change rapidly based on popular trends and lack the stabilizing factors seen in conventional assets. The so-called "liquidity illusion" hides the reality of low trading volumes: joining in when excitement is high is simple, but selling at the right price becomes challenging as feelings change. Numerous platforms boost trading volumes through fake activities, which lowers the clarity for investors following regulations.

Crafting a Disciplined Digital Investment Framework

To invest wisely in digital assets, one must distinguish between empty hype and lasting value. It's essential to prioritize tokens that provide genuine utility, such as solving issues or improving ownership, rather than those driven by speculation, while also assessing technology's scalability and acceptance without getting distracted by celebrity endorsements. A well-rounded approach means focusing on foundational platforms instead of a wide array of tokens. Conducting thorough legal and regulatory checks is crucial, as these can unexpectedly change asset valuations. Wealthy investors tend to take smaller, riskier positions in these assets, considering them as peripheral investments. They understand that innovation can disrupt markets and that early adopters may be overtaken by superior alternatives later on. Achieving success requires combining traditional analysis with an understanding of the potential for transformation in digital tokens.