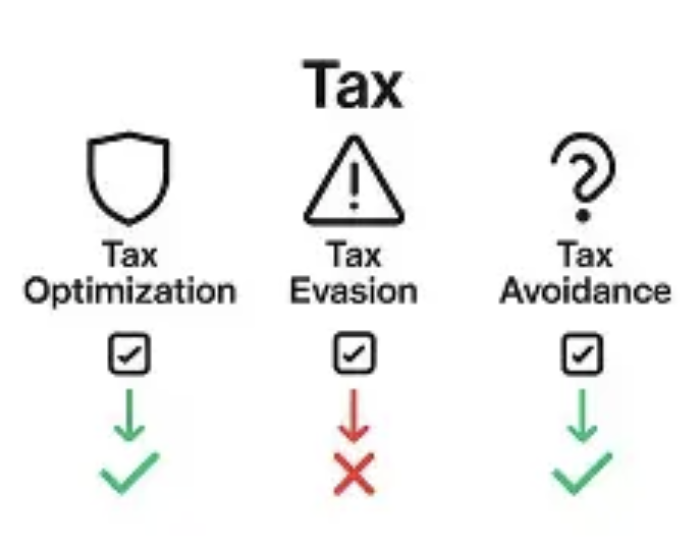

Wealth accumulation frequently results in complicated tax responsibilities, and the boundary between acceptable tax planning and illegal tax evasion is often ambiguous—even among individuals with considerable wealth. Many individuals mistake proactive strategies for unethical avoidance, thereby missing legal opportunities for savings or facing serious consequences by venturing into prohibited practices. The difference is not in reducing tax expenses but in the approaches taken and the intentions behind each tactic.

Proper tax optimization functions within both the intention and the legal framework, utilizing policy advantages to align tax obligations with financial objectives. It is visible, well-documented, and based on forward-thinking strategies. In contrast, tax evasion is based on deceit—concealing revenue, fabricating documents, or incorrectly categorizing assets with the intention to deceive tax authorities. For wealthy individuals, this difference in intent can distinguish between a lawful financial portfolio and facing charges of a criminal nature.

Optimization Utilizes Policy as a Resource

Astute taxpayers capitalize on government incentives to lessen their financial load, using mechanisms such as charitable donation deductions, tax-favored retirement accounts, and international asset arrangements. These should not be seen as loopholes but rather as designed policy instruments aimed at promoting investment, charitable efforts, and economic enhancement. For instance, arranging international assets through compliant trusts or utilizing renewable energy tax incentives signifies proactive optimization rather than evasion.

Evasion's Concealed Long-Term Consequences

Those who violate the law sometimes fail to recognize the repercussions beyond penalties. Engaging in tax evasion can damage one’s reputation, impacting business collaborations, family heritage, and social standing. For individuals with significant wealth, audits can result in asset seizures, criminal charges, and irreversible harm to their personal and professional image—consequences that far surpass any immediate tax benefits.

Cross-Border Assets Increase the Risk

International wealth adds further complexity to the distinction. Proper cross-border strategies employ double tax agreements and clear reporting (like CRS disclosures) to manage tax responsibilities effectively. Conversely, evasion includes hiding funds in offshore accounts without appropriate disclosure. As global tax cooperation becomes stricter, the likelihood of being discovered—even for assets that have been concealed for a long time—has significantly increased.

Documentation: The Foundation of Compliance

Effective tax optimization relies on thorough documentation. Each deduction, credit, and asset arrangement is backed by records that can endure audit examinations. In contrast, evasion depends on obscurity—absent documents, inconsistent submissions, or claims that lack evidence. For wealthy individuals, comprehensive documentation not only guarantees adherence to the law but also facilitates wealth transition and estate management.

Optimization is anticipatory, woven into larger financial plans during phases like asset procurement, business growth, or charitable activities. It includes the engagement of tax experts to foresee responsibilities and make informed decisions. Evasion is a reaction—an attempt to cover up previous transactions or income, frequently driven by anxiety over escalating tax obligations.

Ethics and Legacy Concur with Compliance

For numerous high-net-worth individuals, the legacy of wealth encompasses more than just financial assets; it also includes their reputation. Proper tax optimization aligns with moral standards and family values, steering clear of the stigma and legal perils associated with evasion. It guarantees that wealth is sustained through lawful practices, allowing the transfer of both assets and a legacy of responsible management to future generations.

The distinction between optimization and evasion is evident: one fosters wealth through adherence to regulations, while the other jeopardizes it through deceit. For individuals with significant resources, understanding this distinction is crucial for ensuring long-term financial stability.